Economic Forecasting Model

Last updated on 27th January 2026

Introduction

Acknowledgements

This model has been built using ideas and research from Dr. Sebastian Poledna, and his team at the International Institute for Applied Systems Analysis in Austria.

Below is the abstract from the paper: Economic forecasting with an agent-based model

"We develop the first agent-based model (ABM) that can compete with benchmark VAR and DSGE models in out-of-sample forecasting of macro variables. Our ABM for a small open economy uses micro and macro data from national accounts, sector accounts, input–output tables, government statistics, and census and business demography data. The model incorporates all economic activities as classified by the European System of Accounts (ESA 2010) and includes all economic sectors populated with millions of heterogeneous agents. In addition to being a competitive model framework for forecasts of aggregate variables, the detailed structure of the ABM allows for a breakdown into sector-level forecasts. Using this detailed structure, we demonstrate the ABM by forecasting the medium-run macroeconomic effects of lockdown measures taken in Austria to combat the COVID-19 pandemic. Potential applications of the model include stress-testing and predicting the effects of monetary or fiscal macroeconomic policies."

Model description

The Simudyne small economy model is built in the Simudyne SDK with new calibration techniques and behaviours that enable running the model in a distributed environment and for different national economies.

This is a holistic agent-based model of a small economy for economic forecasting and can be used as an alternative to traditional models like DSGE to predict the dynamics of the system.

Model overview

The model consists of of the following types of agents:

- Firms: Produce goods given demand, available materials, capital, and labour

- Household: Can invest, consume goods, participate in labour market

- Bank: Takes deposits and extends loans with provisions of loans subject to its risk limits

- Central Bank: Sets the policy rate on which bank's interest rate is based

- Government: Levies taxes to provide social services and benefits

- Economy: aggregate demand and supply and functions as the job search market

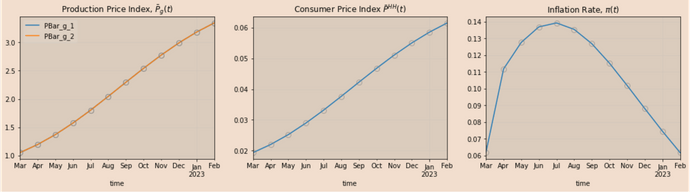

Example forecasting outputs

Below are some sample outputs from the real model that show some of forecasting capabilities of the simulation:

Use cases

There are a number of applications for this type of model and numerous that have not been listed below:

- Economic shock scenarios - changes in availability of resources or in the price of goods and assets

- Consumer level dynamics - availability of labour and changes in consumption patterns

- Impact to revenues / available capital - model changes in the markets, and the environment to understand impact of supply and demand

- Policy changes - change the regulatory environment and study how the economy will react