Mark 0 Simple Economy Model

Last updated on 27th January 2026

The following description and implementation is based on:

“Tipping points in macroeconomic agent-based models”, Gualdi, S., Tarzia, M., Zamponi, F. and Bouchaud, J.P., 2015. Tipping points in macroeconomic agent-based models. Journal of Economic Dynamics and Control, 50, pp.29-61

Download Model FilesModel Overview

The Mark-0 model is an agent-based model purposed to analyse the complex dynamics of a simple economy and its tipping points, i.e., small shocks that can cause the economy to suddenly collapse. Specifically, when the system is close to a tipping point, even a small fluctuation is amplified as the system jumps from one equilibrium to another.

The model looks at a number of features including simple wage policies and firm defaults with bankruptcy threshold Θ.

Agents and Network

There are 2 types of agents in the ABM:

- Firm: The firm employs individual from households and pays a wage to employees. It prices its product at p with a productivity/output P supplying to the economy’s demand. The firm has a profit at each step, a liquidity L, assets (i.e., bank deposit) and liabilities (i.e., debt).

- Household: A household has a number of members available by firms, with an income from employment, has a total consumption budget

The ABM is defined by the following model parameters:

β is the sensitivity of household demand to price

c determines the consumption budget

η+_ is the hiring factor

η-_ is the firing factor

R is the ratio, η+/η-

f is the probability a fund defaulting is not bailed out

γp_ defines the price formation ‘tatonnement’ process

μ can always be set to 1 for simplicity and not relevant as all households are represented by a single agent

Nf_ is the number of firms

δ is the dividend paid to a household

φ is the probability of a defaulted firm to get revived

Θ is the default threshold\

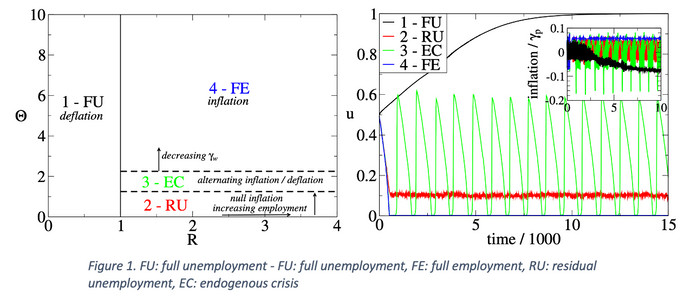

Note that the long-terms dynamics of the model is most sensitive to the parameters R and Θ with the other parameters determining quantitatively the short-term behaviour.

Behaviours

Here, we describe the different phases of the ABM can be in, given the parameters R and Θ.

Specifically, changes in the wage causes inflation in Full Employment and deflation in Full Unemployment. In an Endogenous crisis, we observe alternating cycles of inflation and deflation (and unemployment rate, u) and in the Residual Unemployment phase, we observe no inflation but material residual unemployment.

Defaults

An endogenous crisis can be caused by default of firms. There are two scenarios if a firm exceeds the bankruptcy threshold: Another firm buys the defaulted company The company goes bankrupt, i.e., firing all employees and the debt is covered by the household sector. The frequency of each scenario is controlled by the probability f. Defaults have repercussion on the demand (through reduced wages and savings of the household) or on firms’ fragility (through firms’ net deposits).

Inflation

If wages are updated by the firms, the potential for inflation and deflation exists. The average inflation rate depends on parameters such as the households propensity to consume c and the price/wage adjustment parameters γp,w

The most interesting effect is the appearance of inflation in the “good” phases of the economy, and deflation in the “bad” phases. Increasing γw allows firms to faster adapt wages (and thus prices) and to absorb the indebtment through inflation.

By modifying the model parameters and particularly R and Θ, we can analyse the behaviour of the simple economy in those different phases, including unemployment, defaults and inflation.