Consultancy Model

Last updated on 27th January 2026

An agent-based model (ABM) of a large consulting firm was built by Christopher Stanford at Imperial College London under the supervision of Dr. Wayne Luk. The following work was completed during his Msc thesis and was developed using the Simudyne SDK. This is a theoretical representation of the underlying properties of a consulting firm and provides the opportunity to run Scenario Analysis simulations of the consulting firm.

Download Model FilesAbstract from paper

This paper investigates the modernization of a corporate practice called scenario analysis. It is widely used across the globe, originating from World War II, helping companies to gain a better understanding of potential future outcomes. In order to modernize scenario analysis, this paper will explore the novel approaches; of a hybrid development between agent-based modelling (ABM) and scenario analysis, the utilization of bottom-up and industry view approaches and introducing elements of human social behaviour. All these features are integrated in a single scenario analysis ABM that will model the fundamental philosophy behind the daily operations of a large corporation.

This paper addresses more natural evolutions for scenarios, by looking at the firms’ fundamental building blocks, rather than just an objective view based on the firms’ financial statements. This model will focus upon accurate representations of the daily interactions of an enterprise, especially improving the explainability and transparency of causality in scenario analysis generated by the models, in order to achieve enduring agreements among executives about the firm’s future. With this novel approach to scenario analysis, the modelling of a firm with the use of an ABM, there is the potential to provide more in-depth micro-observations of the future, rather than the conventional scenario analysis methods performed today.

Introduction

This model aims to investigate the novel approach in the modernization process of utilizing scenario analysis, with the use of Agent Based Modelling (ABM). The general application of scenario analysis is to generate best, base, and worst-case scenario analysis of a firms’ financial outcome, based upon potential financial and economic inputs, or future corporate decisions.

For example, this model will focus on people driven services, such as consulting, where some of the key variables are the number of available consultants, more specifically the total availability (count), their billable hour rate, working hours, utilization rate (expected down time), current running contracts, future contracts and expected contracts, in order to derive expected revenue.

ABM for Management Consulting

Some consultancies utilise a two-pronged approach for its scenario analysis. A bottom-up analysis and an industry view analysis. The bottom-up approach is people-oriented and focuses on looking at the total amount of consultants available and calculates the total potential revenue they would be able to generate (also referred to as headcount driven approach). The top-down, or industry view approach, focuses on the current contracts in progress, future contracts that are in the pipeline, and the potential future contracts that may be won with a certain degree of probability (also referred to as demand driven approach).

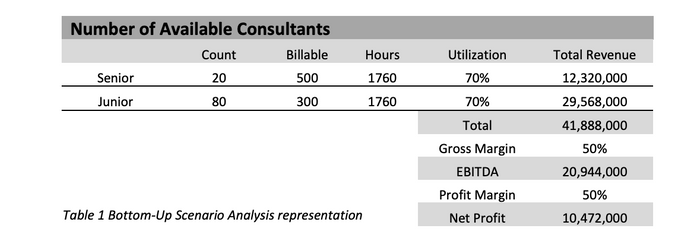

A better representation of this approach is shown in fictional representations of the firm in tables 1 and 2. The first representation is achieved by calculating the expected performance of a consulting firm based upon the total maximum utilization of their employees. This can be seen in the fictitious representation of the company below in table 1.

Based on 20 senior consultants and 80 junior consultants and an assumed utilization rate of 70%, it becomes clear that there is an expected net profit potential of 10 million.

To generate different outcomes, one can either increase or decrease the utilization rate or hours of work. The second parameter utilized is the Industry View Plan. As the name suggests, it is based upon an industry focus view, or a company-specific view. The idea behind this model is to look at the industry as a whole, and analyse sector by sector, in order to provide an estimate of the potential expenditure on consulting fees.

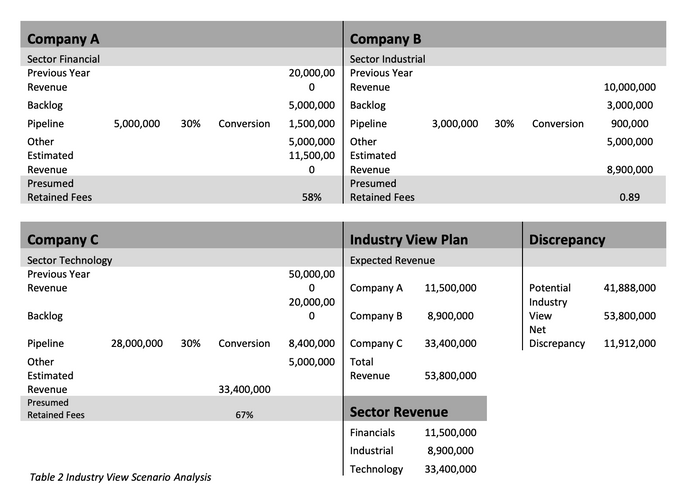

With this method, the firm considers which contracts are already safe, such as signed but not billed contracts (Backlog), and which are expected new contract agreements for the coming year (Pipeline). An example of these parameters can be seen in the following table of imaginary client companies across various industry sectors:

Table 2 shows how the Industry View Plan provides a further representation of the scenario analysis of the company. Table 2 also shows the estimated expected revenue from each company A, B, C, is 11.5m, 8.9m, and 33.5m, respectively.

Lastly, both models are compared, as seen in the bottom right of table 2. This shows the discrepancy between the potential billable income and the estimated client/industry revenue.

This example shows how the expected revenue from the industry view would be higher than the potential revenue from the total workforce. Consequently, to balance the business model in this example, the firm would have to either hire more consultants to meet the demand or would have to shift focus towards more profitable sectors and relationships, to maximise their potential revenue

In order to achieve a bottom-up representation the ABM will integrate the two approaches described above. The ABM will be able to automatically calibrate itself in order to maximize company growth by optimizing its resources and workforce appropriately. This is further expanded upon below.

Agent Definition and Interaction

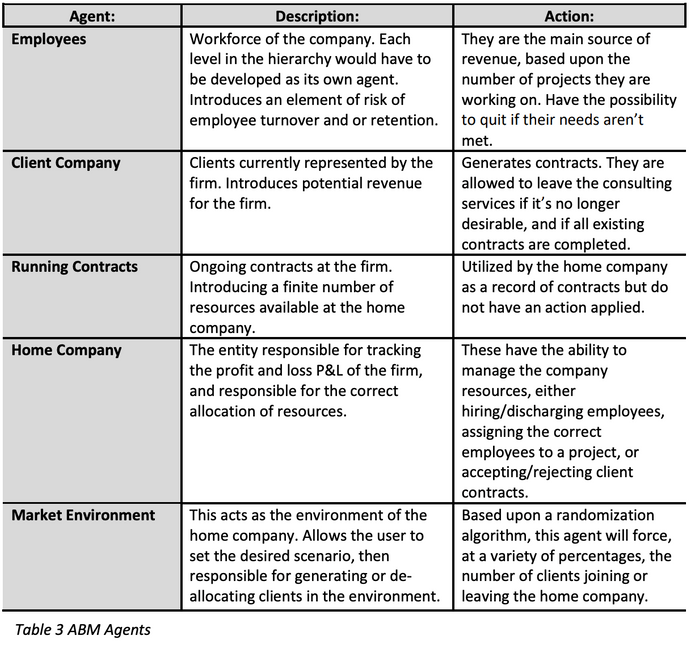

The base model contains the following agents, each with unique characteristics. Employees have project preferences, and consequently a tolerance to undesirable project assignments. If the employee is unhappy with the current work environment, they may leave the firm. This becomes relevant if the market model evolves, and the employees specialized in a specific economic sector, which is shrinking, may be assigned to different department projects. If continued, the employee will become unhappy and resign. This is an important aspect that general scenario analysis would be unable to convey. A description of the agents in the simulation is provided in table 3 below:

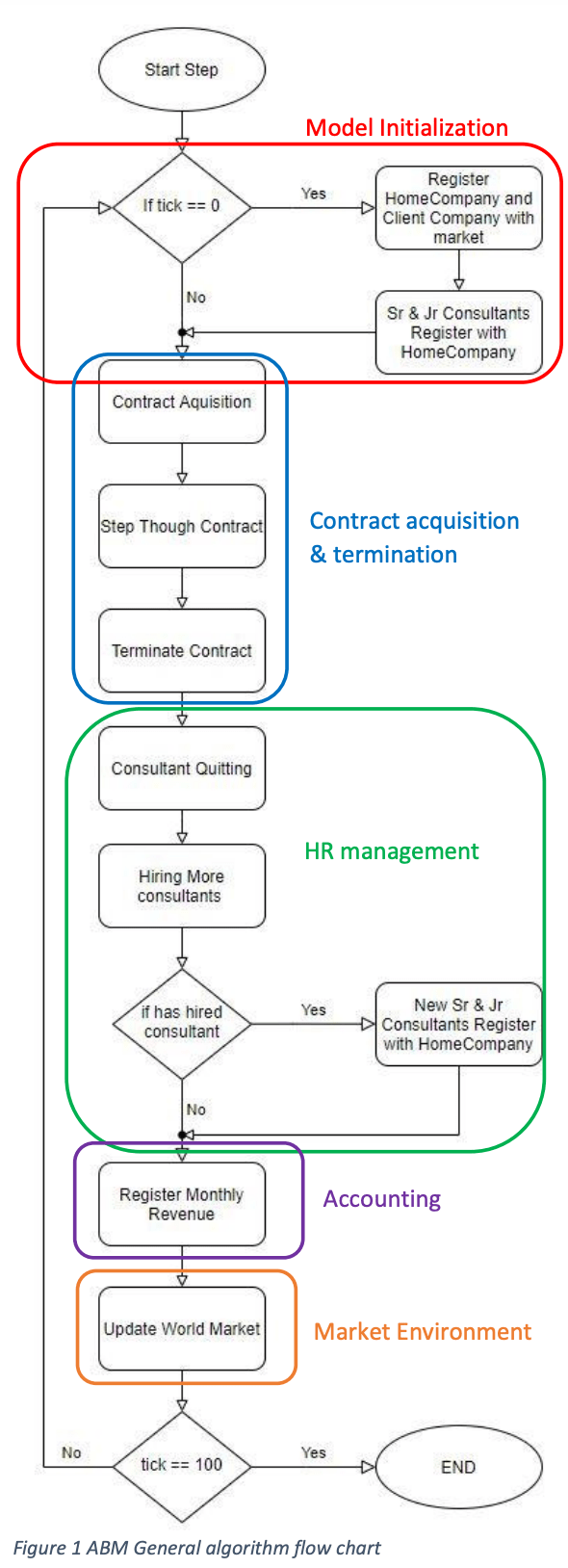

Having designed the key components for the model to be built around, it is fundamental to capture the characteristics of the model as concisely as possible, while maintaining a realistic behaviour. The main characteristics can be condensed in five main categories (as seen in figure 1):

- Model initialization

- Contract Acquisition & Termination

- Human resource (HR)

- Management & Accounting

- The Market environment

Model Initialization: The model allows for ample customization within its starting parameters in order to customize different starting scenarios and calibrate the model to the firms’ current operational structure. During the initialization process the model will generate the necessary agents and setup the links between agents as seen in figure 1.

Contract acquisition & termination: This is the main operation performed by the home company, where depending upon the availability, will choose to either accept a new contract from a client or not. Consequently, it will also terminate and release the assets allocated upon termination.

Human resources (HR) management: An important property of an ABM simulation compared to standard scenario analysis, is the fact that the model is not static, having the ability to grow and contract naturally following the demands of the market. Subsequently, if there is a sudden increase in the number of contracts, the ABM will attempt to recalibrate by hiring additional employees, or vice versa. Additionally, an element of human nature is introduced to the model, where the employees assigned to a project outside of their scope, may feel resentment towards the firm and potentially leave. This functionality can be further expanded upon to meet the workforce needs.

Accounting: This operation is perfomed by the home company agent, which is capable of keeping track of the P&L of the firm, and of each division, on a monthly intervall (which can be regulated depending upon the different industires). Providing a powerful and detailed representation of the current operations of the company.

Market Environment: is responsible for managing the interactions between the home company and client companies. This is achieved by carefully modelling and simulating market behaviours. For the developement of the ABM described in this paper, the market can be toggled between two different scenarios; in the first, the market follows a simple randomised business cycle with a 2% average annual growth (which can be altered by the user), to portray the responsiveness of the model to changes in the environment. Additionally, there is the possibility to have an exponential contraction or expansion to the market, utilized to stress-test the market and analyse potential weak areas in the home company

ABM Network

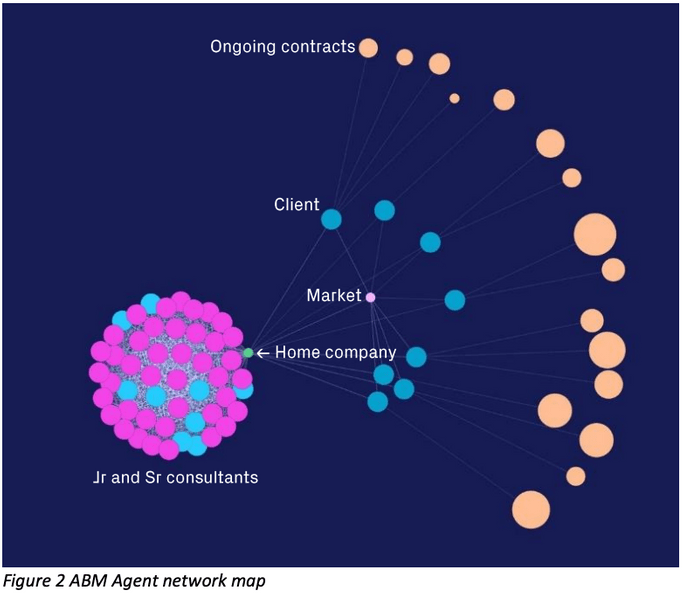

Figure 2 is a graph generated by the Simudyne SDK and shows the links between the different agents generated, and their interactions with one another:

Conclusion

The model is designed from the bottom up, emphasising on the fundamental building blocks of a company, rather than looking at the returns from a purely accounting point of view. Additionally, the implementation of an ABM, allows to not only simulate the operational interactions within the firm, but it also provides the opportunity to introduce some elements of natural behaviour among its employees, in order to introduce an additional element of realism within the model.